FreshBooks vs. Xero: Which Accounting Software is Best in 2025?

Advertisement

In today's fast-paced digital economy, selecting the right accounting software is critical to managing your finances efficiently. As we enter 2025, two platforms—FreshBooks and Xero—remain the go-to choices for small business owners, freelancers, and startups. But how do you know which aligns best with your financial goals and daily operations? This article will explore each platform's key features, pros, cons, pricing, and best use cases.

Whether you're billing by the hour or scaling a product-based business, understanding the true value of each software can give your business a winning edge.

What Is FreshBooks?

FreshBooks is a cloud-based accounting tool for freelancers, consultants, and small service-based businesses. It helps users create invoices, track time, manage expenses, and accept payments online. The interface is user-friendly, making it great for those without a background in accounting.

What Is Xero?

Xero is an online accounting software built for small to mid-sized businesses. It supports invoicing, bank reconciliation, payroll, and inventory tracking tasks. Xero is known for its powerful features, collaboration tools, and ability to scale as your business grows.

Key Features of FreshBooks:

- Invoicing Simplicity:

FreshBooks simplifies invoicing with customizable templates and automated payment reminders. You can generate and send professional invoices within minutes, making it ideal for fast-paced service industries. Clients can also pay directly through the invoice using online payment gateways, speeding up cash flow.

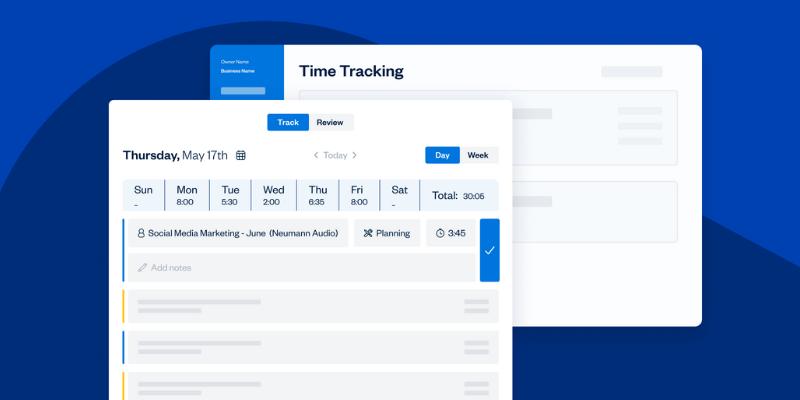

- Time Tracking:

The platform includes a built-in time tracker that allows you to log hours while working on tasks or projects. You can assign tracked time directly to client invoices, making it seamless for hourly billing. This feature is especially beneficial for freelancers and agencies managing multiple clients.

- Expense Management:

FreshBooks provides efficient expense tracking by allowing receipt uploads and automatic categorization. It helps you monitor your spending closely and makes tax time less stressful with organized reports and summaries. You can also connect your bank accounts for real-time expense syncing.

- User Interface:

FreshBooks is widely recognized for its user-friendly interface that requires no prior accounting knowledge. The dashboard is clean, intuitive, and visually organized, helping users focus on key financial activities without getting overwhelmed.

Key Features of Xero:

- Advanced Accounting Tools:

Xero offers comprehensive accounting features such as double-entry accounting, bank reconciliation, and depreciation tracking. It also includes multi-currency functionality, enabling businesses with global clients to handle foreign transactions effortlessly.

- Third-Party Integrations:

With over 1,000 third-party integrations, Xero allows seamless connectivity with tools like Shopify, Salesforce, Gusto, and more. This flexibility helps businesses automate operations in one central ecosystem, from inventory management to customer relations.

- Real-Time Collaboration:

Xero supports multiple users and accountant access with customizable permissions. It enables real-time collaboration on financial records, perfect for businesses with teams or those working with external financial advisors or accountants.

- Mobile App:

Xero's mobile app lets you send invoices, capture receipts, and reconcile transactions while on the go. Though packed with essential features, some users find the interface slightly less intuitive than FreshBooks.

Pros and Cons of FreshBooks and Xero:

FreshBooks:

The Ups and Downs FreshBooks is particularly appealing for solo entrepreneurs and service providers thanks to its streamlined invoicing, built-in time tracking, and stellar customer support. Its intuitive interface makes onboarding quick and effortless, even for those new to accounting software. However, its limitations become more noticeable as businesses scale. The lack of advanced reporting and inventory tracking makes it less suitable for product-based operations or larger teams. Moreover, advanced features are locked behind higher-tier plans, potentially increasing costs for growing businesses.

Xero:

Strengths and Weaknesses Xero is a powerhouse regarding depth and scalability. It offers robust tools for complex accounting needs, such as payroll, inventory, and multi-currency transactions. Its integration capabilities are top-notch, and its collaborative features are a dream for teams. However, it's not the easiest to learn—especially for users without a background in finance. The mobile app can also feel slightly clunky to new users. Another drawback is its reliance on email-based support, which might not be ideal for those needing immediate help.

Best Use Cases of FreshBooks and Xero:

Who Should Use FreshBooks?

FreshBooks is perfect for freelancers, consultants, and service-based entrepreneurs who value ease, speed, and simplicity. It's ideal if your work involves invoicing clients, tracking billable hours, and managing recurring expenses. FreshBooks is your go-to if you're looking for a clean, focused dashboard and strong support.

Who Should Use Xero?

Xero best suits small to medium-sized businesses with growing teams and complex needs. Its feature-rich platform and integration ecosystem offer more flexibility and power if your business handles inventory, multi-currency transactions, or works closely with accountants.

Pricing of FreshBooks and Xero in 2025:

FreshBooks:

- Lite Plan – $17/month: Ideal for freelancers with basic needs and up to 5 clients.

- Plus Plan – $30/month: Adds double-entry accounting and recurring billing.

- Premium Plan – $55/month: Supports up to 500 clients and offers advanced permissions.

- Custom Plan: Designed for enterprises needing tailored solutions and premium support.

Xero:

- Early Plan – $13/month: Basic plan with limits on invoices and bills.

- Growing Plan – $37/month: Unlimited invoices, quotes, and bank reconciliation.

- Established Plan – $70/month: Includes advanced features like multi-currency support, project tracking, and expense claims.

Which Software Is Best in 2025?

The ideal software depends on your business type and scale. FreshBooks is a favorite for independent professionals who value speed and user-friendliness, especially those in creative or service-driven fields. On the other hand, Xero is tailored for businesses on a growth trajectory that requires sophisticated accounting tools, team collaboration, and integration with a broad ecosystem of apps. Each platform shines in different scenarios, so evaluating your business's core needs is key.

Conclusion

Regarding FreshBooks vs. Xero in 2025, both platforms offer powerful solutions for different users. FreshBooks delivers ease of use, making it a reliable option for solo service providers and freelancers. Xero excels with scalability, integrations, and complex financial management, ideal for teams and expanding businesses. The best way to decide is by assessing your business model, future growth plans, and the needed features. Still undecided? Please take advantage of their free trials and test each for yourself. Don't leave your business finances to chance—choose the software that moves with you.

On this page

What Is FreshBooks? What Is Xero? Key Features of FreshBooks: Key Features of Xero: Pros and Cons of FreshBooks and Xero: Best Use Cases of FreshBooks and Xero: Who Should Use FreshBooks? Who Should Use Xero? Pricing of FreshBooks and Xero in 2025: FreshBooks: Xero: Which Software Is Best in 2025? ConclusionAdvertisement

Related Articles

Freshdesk vs Zendesk: Find Out Which is Better in 2025

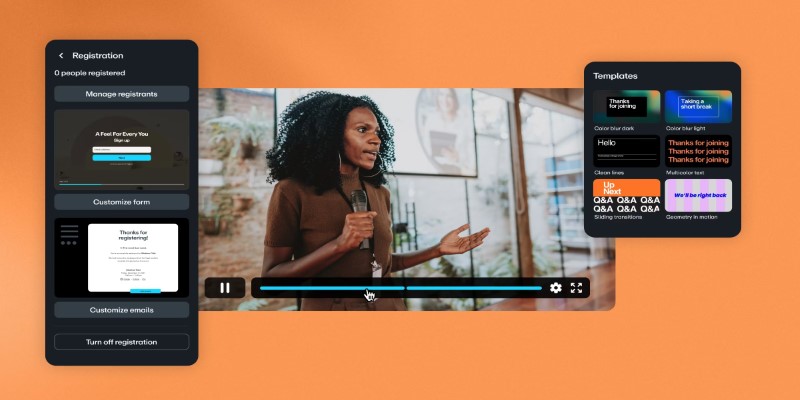

Top Webinar Platforms That Make Hosting Events Easy

Watch Later in MKV: 8 Tools to Save HD Movies Instantly

Why Should You Use Buffer for Social Media?

8 Easy-to-Use WebM Recorders for Windows PC Users

Evernote Vs. OneNote: Best Note-Taking App for 2025 Use

Useful Tips to Solve OBS Audio Delay Issues: A Comprehensive Guide

Browse AI: How to Scrape Any Website Without Writing Code

Customer Portals Explained: What They Are and How They Work

How to Restore the Quality of Blurry Videos Sent From iPhone to Android

Notion vs. Evernote: A Clear Comparison for 2025

novityinfo

novityinfo